What is the Significance of Shrinking Deals?

Sales Rep Believes the Best Possible Outcome (Culprit #1)

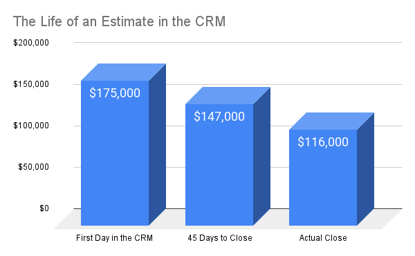

Everyone wants to make a good first impression; prospects want to impress us and we want to impress our bosses and colleagues. A prospect wants your attention and to command it, he is willing to describe an initiative (to which your software relates) in the most glamorous and exciting terms (largest possible deal size). Because we want to believe — this becomes the truth and it becomes the first entry in the CRM. As we can see in the chart above, things change, and the change is normally not in a direction we would like.

The Strategy Within Your Sales Process May Create Risk (Culprit #2)

Most prospects are willing to pay materially more than they present during negotiation. If your sales rep presented a customer fed ROI (Return On Investment) analysis during the sales process, the value of your solution likely exceeds the projected ROI created, as the customer often understates the data provided to your sales rep. In fact, there are usually much larger stakes in play with regard to operational value than whatever the initial price reduction on your system was negotiated with the customer. However, facing an artificial end of the quarter deadline, the default tendency for self-preservation as a sales rep is a dramatic price concession.

In other words, when all else fails, drop the price and close the deal. However, this often used pricing tactic engineered into your sales process should have revealed pricing risk long before you ever got to a price negotiation. So why was the sales rep compelled to drop the price? Two likely reasons: 1) there was not a "compelling event" (an event that is date sensitive with financial consequences for failure to comply) driving the timing of the deal, and 2) the original price was never agreed to by senior management, so the price had to fall to meet certain budget constraints that would allow signature by the customer. Using price discounting as a closing tool destroys forecast projections.

This Feels Like It is Costing Me Money

So let's just accept for a moment that the above graphic does resemble the world in which we live. A deal is entered into the CRM at a high value, and by close it shrinks materially. There are two things going wrong here:

- When investors called before the quarter and asked what the bookings number was, you told them $147k, but ended up at $116k. Not good.

- You thought your return on sales and marketing spend was economic; it wasn't. Not good.

If you have a nine month sales cycle, you are going to think for about eight of those nine months that a salesman is likely demonstrating that she/he will hit his/her booking target AND, as a result, the sale and marketing engine is economic. BUT . . . you got to the finish line and realized the actual bookings were (using the example above of $116k [end point] / $175k [start point]) 33% below target. In other words, you just told shareholders that they are going to suffer 33% economic dilution from where they thought they were. Not good.

Setting up an early warning verification/detection system for deal size estimates is a complex institutional endeavor. As we like to say at MOIC, "Your Process is Your Product". Let our lessons learned become your best practices.