Why Forecast Accuracy Is the Real Multiple Behind SaaS Valuations

Building a subscription-based software company is a lot like manufacturing a bond. The price the market will pay for that bond is driven by two primary attributes: (1) the stability of the current income stream, and (2) the probability that income stream will grow.

Let’s focus on the second one—growth probability—because that’s where the largest variability in valuation multiples typically lives. In software, probability is ultimately a function of confidence. And confidence is a function of accuracy.

So the real question becomes: How accurate is your business at predicting outcomes?

Forecast Accuracy Is the Hidden Driver of Valuation

When we talk about “forecast accuracy” in SaaS, there are two levels to consider: (1) are you hitting the number? and (2) how are you hitting the number?

A brute-force approach to forecasting relies on sheer volume—building massive pipeline coverage to improve the odds of landing on target: “We need 3x pipeline to hit 1x quota.” That method can work, but it’s expensive. It drives headcount, spend, and pressure across the entire organization.

The stronger model is being able to forecast deal by deal—with enough reliability that you can predict outcomes without requiring excessive coverage. And that’s exactly where most teams struggle. They don’t lack data—they lack a reliable way to assess, deal by deal, whether what’s in the pipeline is actually real.

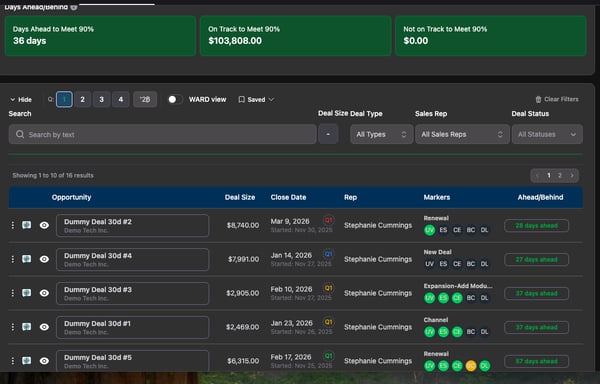

This is the problem Pipeline Grader is built to solve. Pipeline Grader evaluates every active deal in your pipeline against the signals that actually correlate with close outcomes—deal structure, buying behavior, timing, and risk indicators—so you can distinguish probable revenue from hopeful revenue.

That capability produces:

-

higher forecast accuracy

-

higher confidence

-

higher assigned probability of growth

-

and ultimately a higher revenue multiple

The Bottom Line

If you can improve forecast accuracy at the deal level, you favorably impact the biggest contributor to your “bond price”—your exit valuation—while also reducing cash burn. If you’d like to understand how to do this, and lower your burn at the same time, please visit us at www.moicpartners.com.