Time savings aren’t compelling — measurable revenue or cost impact is.

A show of hands please ... who recognizes that enterprise software deals cannot be sold without a compelling case? Now that this is settled (they cannot, unless the customer did their own business case and forgot to tell the salesperson), who thinks that time savings equals compelling? Hint: no self-respecting CFO regards a time savings on its own as truly compelling, since they are paying the people anyway. The only cost savings that count are "hard dollar" savings.

The absence of a compelling event and a vetting of the business case with the customer's decision maker contribute heavily to not understanding what is going to close in the short term (or ever). This lack of predictability is how you get a customer acquisition cost (CAC) that depletes shareholder value and burns cash, which does not play well during Board of Directors meetings.

In other words, by definition, if our software only reduces the time that it takes to perform a function, our business case is inherently not compelling; unless, of course, the time saved can be proven to be used to drive increased revenue (reduced time to generate a land title, allows for oil production to occur sooner and generate revenue faster, as an example).

So what is the definition of compelling, since this is the key element of the compelling business case? Let’s start with the fact there are only two ways that we can measure the success of our software: does it drive incremental revenue for our customer, or does it lower our customer’s cost basis? Therefore, the business case can only be compelling if it dramatically drives one of these two measurable results.

However, even if we uncover a business case that drives significant revenue, how do we ensure that our competitors can’t make this same claim and “me too” our business case? Any guesses? The answer is not surprising, yet it is often overlooked.

The nuance is that the results must be driven by our functionality that is universally accepted as unique to our software. This way the business case is specific to us and we’re not doing the business case for our competitors as well.

It is shocking how many business cases either are too dependent on time savings or are too generic with regard to functionality and, therefore, fail our test of a compelling business case. Frequently, all it takes is to fine tune an existing business case to incorporate these unique features toward the measurement of increased customer revenue or reduced customer costs.

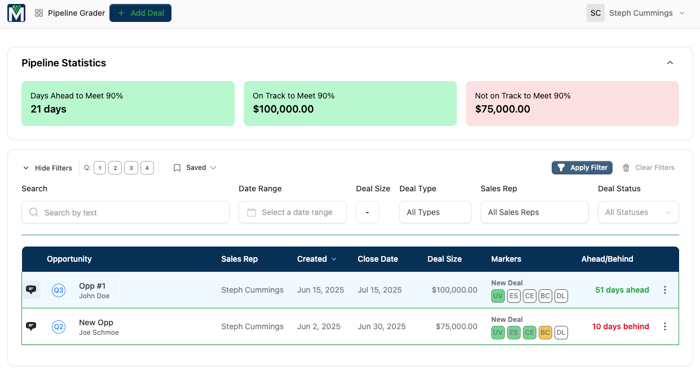

Conversely, if we find that we cannot generate a compelling business case for a prospective customer, we can disqualify ourselves faster and pursue opportunities for which our business case is compelling (MOIC Pipeline Grader leverages algorithmic direction for when to self-disqualify with its Wins Against Replacement Deal methodology).

Once we’ve defined what a compelling business case truly looks like, the next step is to measure and apply it across real opportunities. That’s exactly what Pipeline Grader does — here’s a look at it in action:

If your SaaS sales team struggles to consistently generate a compelling business case, but chases deals anyway, please visit moicpartners.com for guidance.