Stop guessing. Start scaling.

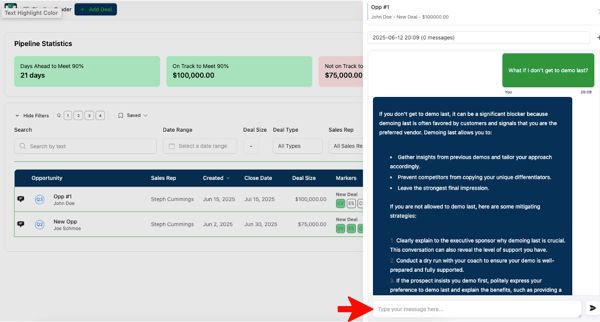

We rely on deal-by-deal forecasting. We don't weight deals in the forecast, they either are going to happen in the time frame or not. The beauty of selling enterprise software is buyer intent is objectively observable - you just have to know what you are looking for and how to confirm what you find.

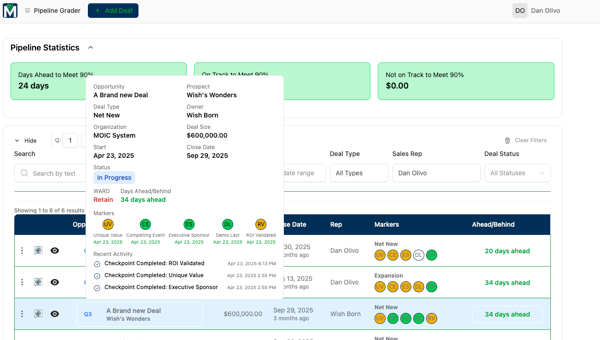

Pipeline Grader helps you on two fronts: (a) early detection in competitive deals whether or not you are a stalking horse with no real chance; and, (b) avoiding qualifying yourself out by not selling the way the buyer wants to buy. You do not need 3x pipeline to cover your forecast for enterprise software deals. You just need to know very early on which ones are real.

How Does It Work?

- Business Case Method — Forces prospect to acknowledge your uniqueness in dollars. Without this you likely become a stalking horse and are not sure if you should drop a deal. As a result you carry more deals than actually required to meet your numbers.

- AI Engine (proprietary) - Enables you to cross check and verify if you are (a) being used as a stalking horse in a competitive deal; and, (b) selling the way upmarket accounts want to buy and as a result not disqualifying yourself.

Enterprise Results

- Targeting Improved 50% - Lower forecast coverage requirements from 3x to 1.5x. This is how you lower customer acquisition cost substantially lowering your burn and materially increasing your value.

Where most up and coming enterprise software companies feel pain is the price of acquiring experience. The learning curve for determining what works in the sales process and what does not is very steep for a very long time. When you go upmarket, the complexity increases as the demographic changes. Upmarket prospects typically know how to buy better than you know how to sell.

So imagine for a moment you knew ten years ago, what you know today. That is Compass for enterprise software sales. Compass brings to your company the know how for large operators such as SAP, Oracle, Salesforce, Seibel. 40 years of experience in the palm of your hand that understands exactly what you should be doing.

Pricing Engine isolates your differentiated value within a competitive matrix, enabling a SaaS pricing strategy that maximizes revenue, retention, and flexibility. Built on proven enterprise best practices, this framework aligns price to user personas, volume, and contract term—optimizing every deal through a modular, named-user model with scalable add-ons.

What is Pricing Engine?

Pricing Engine is a structured methodology for isolating your company’s unique value proposition within a pricing framework that neutralizes competition. It is particularly suited for SaaS providers aiming to convert differentiated capability into scalable, predictable revenue. The approach combines modular pricing, persona-based licensing, and term-based discounts to balance competitiveness with profitability.

Expected Benefits

- Maximize the value of every deal

- Preserve future revenue growth while minimizing downsizing

- Enhance customer retention and lifetime value

- Increase ARR per deal by up to 20%

- Strengthen pricing governance and cross-functional alignment

Features and Add-ons

- Modular base and add-on pricing

- Volume and term discount optimization

- Governance framework and diagnostic review

- Workshop-based implementation

Our Process

- Diagnostics Phase – We perform a structured review of your current pricing model, including your product offering, pricing flexibility, and revenue model effectiveness.

- Workshop Implementation – A focused two-day engagement to design and validate a new pricing architecture, aligning teams around a governance model and competitive roadmap.

- Execution Support – Optional implementation advisory for rollout, governance, and ongoing optimization.

"MOIC opened my eyes to a completely new way of selling. Together we built a case study that demonstrated tangible, quantifiable returns targeted at executives with real buying power."

TechVora

"The fog has lifted."

RigER

"I have been consistently impressed by his dedication, professionalism, and ability to create tangible sales results over a very short period."

Detechtion Technologies

The key to increasing an enterprise software company’s value is winning meaningful upmarket logos. These customers buy through complex committees, requiring success in four parallel sales cycles: the Initiative, the Competition, IT, and the Budget.

Founder-led sales teams are often unprepared for this complexity—frequently serving as stalking horses or disqualifying themselves by selling the wrong way. The result: wasted sales effort, cash burn, and lower exit value.

MOIC's application suite applies a distinct philosophy—the Business Case Method—to detect prospect intent and remove bias from pipeline inclusion. It uses a binomial, deal-by-deal forecasting approach where accuracy below 90% signals systemic issues. By focusing on the top third of the pipeline and analyzing “Wins Above Replacement Deals” (which contemplates prospect behavior against temporal standards for organizational change projects), teams can quickly isolate forecast errors, expose behavioral patterns, and eliminate waste.